There are certain ‘rules’ of business that you just can’t innovate past. No matter how clever you are, you’re not going to create a successful business without having a revenue model or an understanding of who your target market is, for example.

One of these rules, and one that’s particularly relevant to the flexible office sector, relates to location strategy. If your business is represented in the physical world (ie. it doesn’t operate online-only), considering location strategy is integral to potential success. Get your location strategy wrong and you’ll struggle, even if you get everything else right.

It’s especially important in the flexible office sector because we spend a lot of time in the office – the difference between a good location and a bad one is amplified by the prominence it takes in our lives.

So, with that in mind, here are some of our top business location strategy tips to consider as a flexible office operator – whether you’re looking to open your first workspace or you’re expanding into a new area.

Understand who you’re targeting

Determining your target market is an integral part of any business intelligence process and is an essential part of general brand positioning activities, so it’s no surprise that it’s the first and most important step in a business location strategy process, too.

In the flexible office sector, there are certain elements of ‘who’ your target market is that are particularly relevant to your location strategy, including:

- Where they live – What city or county are they from? Do they live in an urban, suburban, or rural setting?

- How they travel – Are they drivers? Do they use public transport? What’s their acceptable commute radius?

- What amenities they need access to – Do they need to be in close proximity to industry-specific business centres? How passionate are they about having a nearby artisan coffee shop?

Once you’ve figured out what the locational needs of your target market are, you’re one step closer to understanding where you should locate your workspace.

Consider cost/benefit

Cost/benefit analysis also plays into locational strategy. Understandably, the cost or rental prices of commercial property varies massively depending on where you are. In London, for instance, you’ll pay around £480 annually per square foot on average for prime office space property, whereas in Leeds the average cost for the same square foot would be around £100.

This is a startling difference, and at first glance it might lead you to believe that you’re priced out of certain areas. However, utilising cost/benefit analysis can help you to create a standardised benchmark of the opportunity presented.

Returning to the London/Leeds comparison, if your cost/benefit research indicates that your target market appears in London at five time the rate that they do in Leeds, the difference in price of rent no longer seems as negative. Obviously there are a huge range of other factors to consider beyond rent costs and density of target market, including the level of competition, but the underlying concept holds true.

Analyse competition and market share availability

On that note, carrying out office market research into the levels of competition and the density of your target market in each location you’re considering is essential.

Some cities will already have a plethora of established flexible or coworking spaces, making the proposition of you being able to break in and crack the market a little less likely. Other areas will be relatively untapped markets, with a general rule of thumb that the less urban the area, the less competition there’ll be.

Going a step further to identify roughly what percentage of your target market have already had their needs met by a competitor is another way of solidifying your research. To use an illustrative metaphor – you want to make sure you’re entering the right size pond, with the right number of fish in it.

Make sure your strategy is future-proof

The times change, and with it new trends and habits emerge. Already, the impact of COVID-19 is uprooting decades of learned behaviour – it’s no longer the case that a privately leased office in the nearest city centre is the de-facto choice for businesses.

Commercial property is expensive, and lease agreements are often long and difficult to get out of, so making sure that your choice of location is future-proof is essential. This is arguably the trickiest part of workspace location strategy to get right, making sure that your choice that makes sense now won’t be outdated in three years.

How exactly you future-proof your location strategy depends on your business model and target market, but a general trend to take notice of is that we’re heading towards a world that’s increasingly driven by localism.

People want to work close to where they live, cutting commutes and achieving better work-life balance. Taking that zeitgeist change into account might take the form of positioning your workspace close to population centres, or at least having the right transport links to make sure it’s not too difficult to reach from further afield.

Think about format diversity

Another thing to consider in your location strategy is the growing importance of different locational formats. Years ago, supermarkets realised that adapting the format of their stores into several different well-defined sizes allowed them to target consumers more appropriately depending on location. This resulted in the emergence of the supermarket formats we’re now used to – exemplified by Tesco’s Express, Metro, Superstore, and Extra model.

This same approach is now relevant to the flexible office market, too, with demand for workspaces no longer limited to city centres. Instead, demand has bled out into suburbs and rural areas, where customers are looking for professional environments to work close to home. How can you capitalise on this trend towards hyper-localisation and targeted formatting of places?

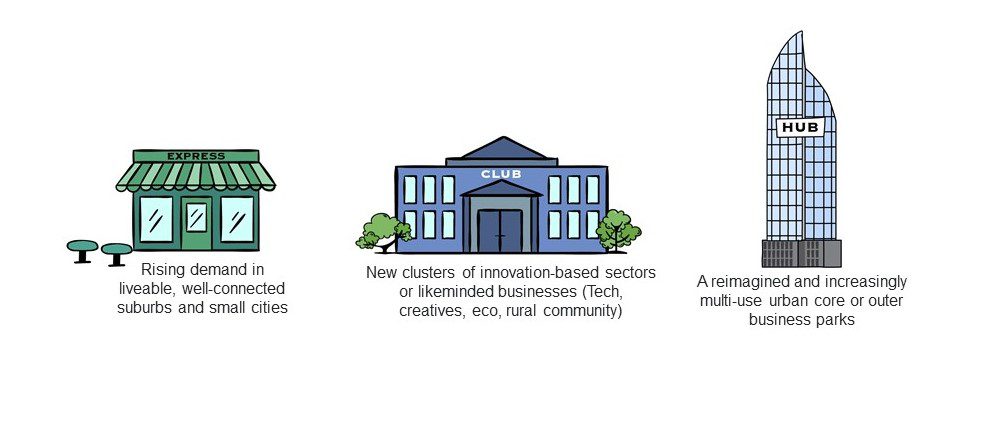

We envisage here main formats of office spaces becoming commonplace in towns and cities across the UK:

- Express – Targeting rising demand in liveable well-connected suburbs and small cities. Express locations are small-format, easy to access, on-demand services with a community focus.

- Club – Targeting clusters of innovation-based sectors or like-minded businesses. Club venues prioritise specialisation that balances accessibility with value.

- Hub – Targeting uses in reimagined and increasingly multi-use urban cores and business parks. Designed for whole-day work and positioned close to after-work amenities, with a focus on a diverse crowd, excellent facilities, and a larger format.

Watch this short video for more information on flexible office formats for the future..

Get help with your location strategy

If you’re an existing flexible office operator looking to expand into a new area or a new operator trying to pick your first, location strategy should be one of your main priorities. Spaces To Places are experts in the flexible office market, and our research services include locational planning research to help you build an understanding of the pros and cons of potential areas of interest.

Get in touch with us today for a free consultation call where we can outline how we can help make sure your location strategy process is a success.