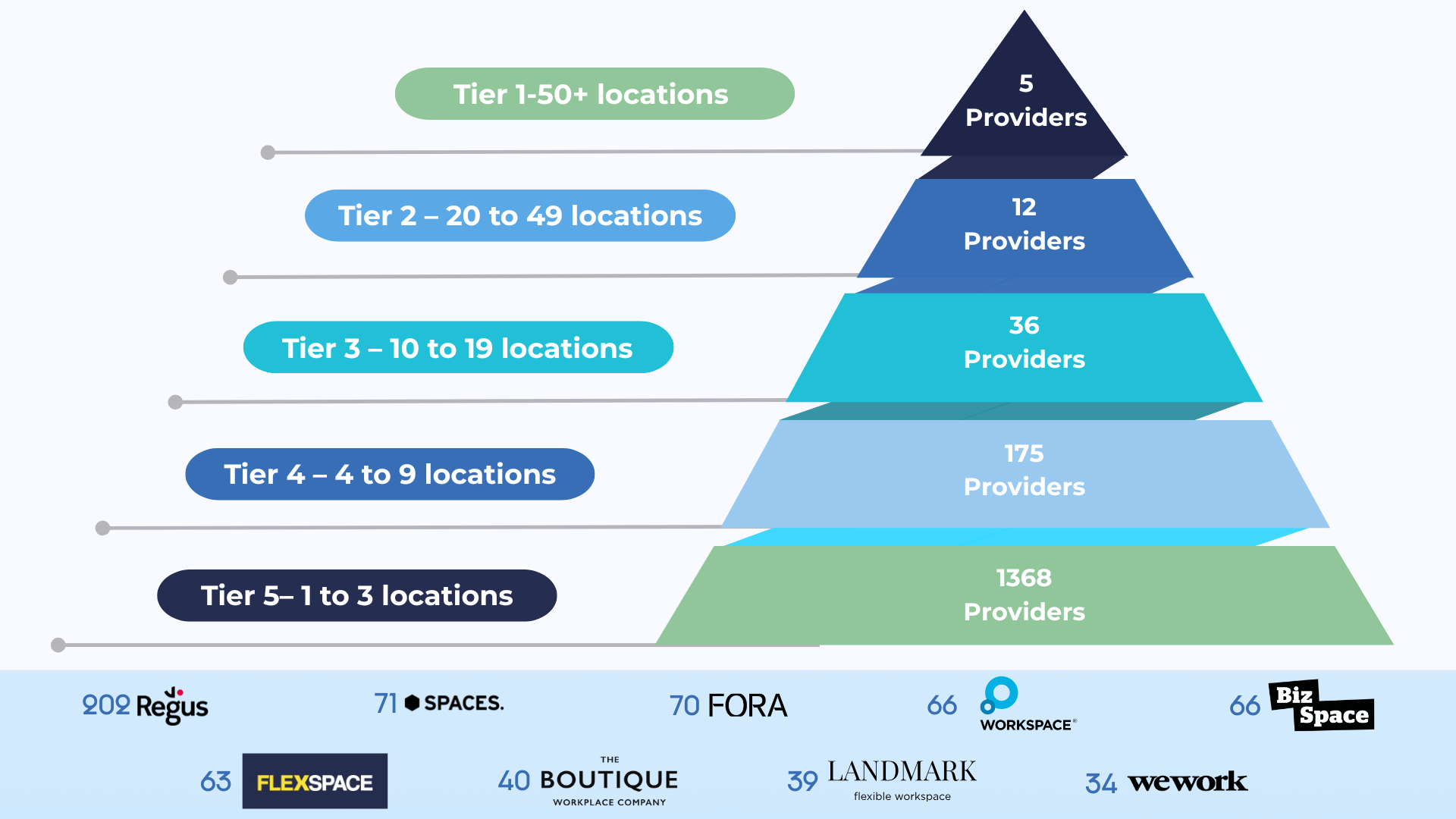

From bustling city office hubs to neighbourhood workplaces, the UK flexible workspace market (Coworking and serviced offices) is diverse, with established giants and rising stars vying for dominance.

Although the majority of the coworking and serviced office market in UK is made up of small operators with less than 6 locations, with the biggest flexible workspace providers focus on urban cities. In London the top 10 key players alone account for 60% of the market, a testament to the power that big brands hold. Read our London Flex Brand report (London Flex Brand Index | Video & White Paper | Spaces to Places) and blog (London Flex Brand Index: A Snapshot of the City’s Thriving Flexible Workspace Market – Spaces to Places) for more details.

This blog below dives into the 9 top players in UK by number of locations from IWG’s global expansion and The Boutique’s Workplaces portfolio growth to Workspace’s London stronghold and WeWork’s dramatic restructuring. We explore the strategies, successes, and challenges of industry leaders like Fora (following The Office Group merger), Landmark, Argyll, Bizspace, and Oxford Innovation Spaces, revealing the trends shaping the future of work.

If you need help navigating this market, please do book a call (Contact Us | Spaces to Places) we would be happy to help providing impartial and independent guidance.

Click on a name below to find out a little more about each business and a link to their website.

Locations: 202

Regus maintains its position as the UK’s largest flexible workspace operator with 202 locations, forming part of International Workplace Group’s (IWG) dominant portfolio that spans approximately 320 centres across six brands nationwide. As the pioneer of flexible workspace since 1989, Regus operates as the cornerstone of IWG’s UK expansion strategy, which includes ambitious plans to add over 30 new Regus centres through franchise partnerships over the next three to four years.

Recent franchise agreements include Kash Group of Companies opening 10 centres in South Oxfordshire and Bedfordshire, AMA Workspaces Limited launching 5 centres in southwest London, SME Group Plc unveiling 10 centres across northwest London, and Q-Boid Limited opening 5 centres in Northamptonshire.

Locations: 71

Spaces, IWG’s creative workspace brand established in 2008, operates 39 locations across the UK as part of the group’s strategy to target entrepreneurs, startups, and creative businesses seeking design-led environments. The brand positions itself as the dynamic alternative to traditional serviced offices, ranking fifth among UK coworking operators despite significant market consolidation following pandemic-related challenges.

Spaces centres feature bold design elements, speciality coffee offerings, and community programming designed to foster collaboration among members. The brand benefits from IWG’s global infrastructure, including recent technology integrations and suburban market expansion strategies.

Locations: 70

The Office Group (TOG), founded in 2004, and Fora, established in 2014, merged in 2022 to operate under the Fora brand. This merger of Brockton Capital’s Fora and Blackstone’s TOG has created central London’s largest single-brand flexible workspace provider.

The combined company boasts over 70 premium workspaces across London, exceeding 3.2 million square feet. With 61 locations strategically positioned within zones 1&2, Fora now surpasses WeWork’s current presence in the capital.

Distinguished by its ownership model, Fora primarily owns its building freeholds, contrasting with traditional lease-based providers. Following Blackstone’s majority acquisition of TOG in 2017 (valued at £500 million), the merged entity has actively expanded its portfolio. Recent developments include the opening of owned assets such as Chancery House, Montacute Yards, and Black & White. The company’s portfolio originally comprised 9 freeholds/long leaseholds (264,124 sq ft) and 6 leaseholds (262,079 square feet), with additional presence across nine UK and German cities.

Sources of information:

Blackstone and Brockton’s Flexible Office Business Rebrands and Roars Past WeWork in Central London

Locations: 66

Workspace Group PLC, established in 1997 and listed on the London Stock Exchange, is London’s premier flexible workspace provider, operating across 95 locations, including studios, light industrial spaces, and workshops throughout the UK. Their predominantly freehold campus style portfolio as a Real Estate Investment Trust encompasses 4.5 million sq. ft. of sustainable space across 77 locations in London and the South East, cementing their position in the market.

Recent reports demonstrate robust performance with a 6% increase in average rent per square foot over the past year, maintaining their long-term growth trajectory. Under CFO Dave Benson’s leadership, Workspace maintains its strategic focus on serving SMEs through smaller units from a variety of sectors, which have demonstrated strong demand and reduced void periods. While experiencing temporary fluctuations in rental and occupancy rates due to ongoing asset management activities and refurbishments, the company attributes any decline in larger space demand to market conditions and acquisition-related lease timing rather than structural changes.

Sources of information:

Locations: 66

BizSpace, acquired by Sirius Real Estate in November 2021, maintains a strategic network of 75 locations positioned around major UK city suburbs, serving 3,901 tenants. The flexible workspace provider has seen significant growth in its corporate client base, with its top 100 tenants now representing 28.3% of annualised income, while SMEs and micro-SMEs comprise 71.7% of their tenant mix.

The acquisition of Vantage Point, Gloucester in April 2024 has substantially increased their net lettable space and total rent roll. BizSpace’s portfolio boasts impressive metrics with a £466.5m gross asset value and £65.7m rent roll, maintaining an occupancy rate of 85.6%.

The company’s business model offers flexible terms at premium rates, with properties valued at a 9.3% net yield, demonstrating strong market performance in the suburban office sector.

Sources of information:

Sirius Real Estate Half Year Report and Accounts

Sirius Real Estate Half Year Results Presentation

Locations: 63

Flexspace operates 52 sites across England, Scotland and Wales, providing more than 2,500 versatile workspaces through a unique multi-use business model that differentiates it from traditional coworking operators. Established through the 2017 merger of 50 Evans Easyspace centres with an existing portfolio of 8 Flexspace centres, the company offers flexible business units, workshops, storage solutions, and office spaces on straightforward 12-month agreements.

The provider’s portfolio spans diverse businesses serving traditional office users alongside workshops, gyms, cafes, beauticians, and therapy practices. Flexspace’s business model emphasises simplicity with clear pricing, straightforward terms and conditions, and ground-floor units featuring private front doors and 24-hour access. The company’s strategic focus on suburban and industrial locations provides cost-effective alternatives to central business districts, with free car parking, high-speed internet connectivity, and furnished options as standard offerings.

Locations: 40

The Boutique Workplace Company demonstrates significant expansion in 2024, reaching 40 locations across the UK, with notable additions including a prestigious 15-year lease at Frederick’s Place, a Grade II listed building in Bank. The company’s growth includes a newly launched serviced office space at Glasgow’s iconic 9 George Square and a partnership with Unite Students in Aldgate.

Since 2019, the operator has significantly expanded their portfolio through a lease model. This approach has driven growth into new markets like Birmingham and Glasgow, as well as increased their presence in Southwest London. Their unique selling point lies in their collection of boutique buildings, each with distinct heritage and character, located in iconic London addresses and beyond. These unbranded workspaces offer tenants the flexibility to create truly bespoke environments.

Sources of information:

The Boutique Workplace Company launches at 9 George Square, Glasgow

The Boutique Workplace Company signs 18,000 square feet in the City of London

Locations: 39

Landmark stands as a significant player in the UK’s premium flexible workspace market, with a strategic portfolio of 41 buildings concentrated primarily in key urban areas. The workspace provider maintains a strong London-centric presence with 33 locations in prime areas of the capital, demonstrating their focus on high-value business districts.

This growth was fueled by the merger with i2 Offices and then in 2019 the acquisition of the London centric brand The Space. Landmark has a strong regional presence with 8 offices outside London offering businesses access to premium flexible workspace solutions in key markets.

Locations: 34

WeWork‘s UK presence has significantly contracted from 55 to 34 locations across the UK and Ireland amid global restructuring efforts. Despite challenges, London remains a stronghold for the company, with its flagship location at 10 York Road, Waterloo, maintaining its position as WeWork’s most popular global location in 2024, alongside strong performance from 123 Buckingham Palace Road and Moor Place.

Following bankruptcy proceedings in late 2023, WeWork has undergone substantial portfolio rationalisation, closing multiple London locations including The Hewett and properties in Shoreditch, City, and Midtown. However, the coworking giant maintains resilience with half a million global users and a 17% membership growth in 2023. The company’s global restructuring has resulted in amendments to over 170 office leases and exits from 160 locations, reducing future rent commitments by $12 billion. WeWork now operates approximately 45 million square feet across 600 locations worldwide.

Sources of information:

Everything you need to know about WeWork in 2025

Free UK Flex Market Reports

Discover the 2025 UK Flex Office Outlook. Get quarterly reports packed with data, trends, and insights for smarter decisions in a shifting workspace market.